Why Millennials Are Flocking to Estate Planning—And Why You Should Too

I was speaking with my brother-in-law this weekend and he was shocked to hear that more and more young families are looking into establishing an Estate Plan early in life. It’s good to see so many young people thinking about the future, not just for themselves but for the people they love the most. Now, just like my brother-in-law, I know that when you hear the words "Estate Planning," it might not sound like the most exciting thing in the world. Or, you might think it’s just something for Senior Citizens to worry about. But let me tell you why it’s actually one of the most important things you can do.

We all know that life can be unpredictable. As the father of two daughters and two sons, I can tell you firsthand that there’s nothing more important than making sure your family is taken care of, no matter what. And that’s exactly what estate planning is all about. It’s about putting a plan in place so that your loved ones are protected, and your wishes are honored.

Now, I’m happy to see that more and more young families are catching on to this. Recent data shows that Millennials—those of you in your late 20s to early 40s—are increasingly taking estate planning seriously. You’re stepping up, making sure that your kids, your homes, and even your digital lives are taken care of. This is a trend that’s not just wise; it’s essential.

Here’s why this matters. Let’s say you’ve just had your first child. You’re thinking about diapers and daycare, not so much about wills and trusts. But that’s exactly when you should start thinking about it. Because estate planning isn’t just for the wealthy, it’s for anyone who cares about their family’s future. Whether it’s designating guardians for your kids, setting up a trust for their education, or making sure your healthcare wishes are known, these are steps that can give you peace of mind—and give your family a secure future.

Understanding the Trend: A Look at the Numbers

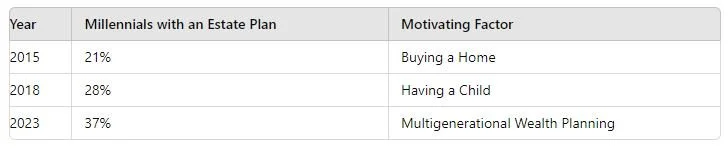

Let’s dive into some numbers to see just how much this trend has grown:

Millennials Estate Planning Survey

As you can see from the table, the percentage of Millennials who have an estate plan has been steadily increasing. What’s more, the reasons behind these plans are evolving. Early on, it might have been about buying a home. But now, many of you are thinking about the bigger picture—creating a legacy that lasts for generations.

Growth in Estate Planning Among Millennials (2015-2023)

As this chart shows, there’s been a marked increase in estate planning among Millennials, especially in the last five years. It’s a trend that speaks to a deeper understanding of what it means to build and protect your family’s future.

Why This Trend is Here to Stay

So, why is this trend so important? Because when you create an estate plan, you’re not just signing a bunch of papers. You’re making a commitment—to your family, to your values, and to your future. And that’s something we can all get behind.

For young families, this means making sure your kids are provided for if something happens to you. It means having a plan for your assets, your debts, and your healthcare. It’s about taking control of your future, rather than leaving it up to chance. And as more Millennials take these steps, I believe we’re going to see a stronger, more secure generation rising up—one that’s ready to face whatever challenges come its way.

So, if you’re reading this and you haven’t started your estate plan yet, I encourage you to take that step. Talk to a professional, make a plan, and give yourself the peace of mind that comes from knowing your family is protected.

Because at the end of the day, estate planning isn’t just about documents—it’s about legacy, it’s about love, and it’s about the future we’re all building together.

We can help! Start by booking a Peace of Mind Planning Session. We can meet in person or via Zoom. You’ll share your concerns, and we’ll present your options, our packages, and our unique flat fees. Then, if we decide we are a good fit to work together, we’ll take the next steps. You can book your Peace of Mind Planning Session HERE. Mention this blog and we’ll waive the $450 session fee!

PS - Like what you read? Send this blog to a friend!